Domestic Partner Benefits

The following benefits are extended to certified domestic partners of eligible faculty and staff:

- Health coverage (medical, dental and vision)

- Educational benefits

- Bereavement leave in the case of death of the domestic partner or a parent of the domestic partner

- Dependent Life Insurance

Students enrolled in University health coverage and that would like to add a domestic partner to their benefits coverage should refer to this page.

Certification of Domestic Partnerships

A completed and notarized Affidavit of Domestic Partnership must be submitted to the Office of Human Resources Benefits Department. Documentation to verify that the domestic partnership meets the criteria described in the University of Pittsburgh Affidavit of Domestic Partnership will be required. Prior to submitting the completed Affidavit of Domestic Partnership and supporting documentation, please review the below information regarding the tax implications of a domestic partnership to better understand the taxation process.

Affidavit of Domestic Partnership

A domestic partnership, as defined by the University of Pittsburgh, is defined as a committed relationship between two adults of the same or opposite sex, which meet the criteria described in the University of Pittsburgh Affidavit of Domestic Partnership.

Note: If a prior Affidavit was submitted and not approved, a new, notarized Affidavit is required at the next attempt of submittal.

Required Documentation

Shared financial obligations, as demonstrated by fulfilling at least two (2) of the following criteria, are required when establishing a domestic partnership with the University:

- Employee and domestic partner have been common or joint owners of a residence (house, condominium, or mobile home) or held a common or joint residential lease identifying both partners as tenants for at least 12 consecutive months prior to the application date

- Employee and domestic partner have shared at least two (2) of the following for at least 12 consecutive months prior to the application date (note: documentation is required to illustrate shared financial obligation for at least 12 months prior to application date, as well as currently):

- Joint ownership of a motor vehicle

- Joint checking account or joint savings account

- Joint credit account or join mortgage account

- The domestic partner has been designated as a primary beneficiary on one (1) of the following for at least 12 consecutive months prior to the current date:

- Employee's University of Pittsburgh Group Term Life Insurance or other Group Term or Whole Life policy

- Employee's University of Pittsburgh Retirement Program or other group-sponsored retirement program

- Employee's notarized will OR domestic partner and employee have a reciprocal durable Medical Power of Attorney for the past 12 months OR domestic partner and employee have a sanctioned union by a governmental body for the past 12 months

Note: Documentation establishing the existence and duration of any of these criteria may be required when establishing the domestic partnership with the University.

Adding a Domestic Partner to your Benefits

If you are enrolling in your benefits for the first time or making changes (whether through a life event or during open enrollment), you must first add your domestic partner to the People to Cover section, which is located in the Benefits section in Pitt Worx and then you must upload the processed Affidavit of Domestic Partnership in the Document Records section in Pitt Worx. These two steps, in addition to having the processed Affidavit of Domestic Partnership, are required prior to enrolling in or making changes to your benefits.

More information about adding dependents to your benefits coverage can be found on the Pitt Worx Hub.

Tax Implications of a Domestic Partnership

Faculty and Staff Not in a Bargaining Unit

After-Tax Deduction

The University follows guidance of the IRS in determining taxation of benefits. The employee contribution towards the cost of adding a domestic partner will be taken on an after-tax basis.

To calculate the after-tax deduction, please see the below example:

Electing two adult coverage under Panther Gold

(July 1, 2023 – June 30, 2024)

Two Adult Contribution $331

Individual Contribution - $91

Total After-Tax Amount $240

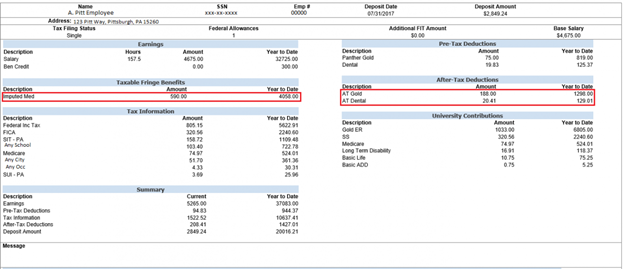

Imputed Income

Imputed income is the estimated value of the employer’s financial contribution towards health insurance coverage for domestic partners and must be reported as taxable wages earned. This tax penalty, depending on the individual and the estimated value of the health benefit, can be large. You are advised to consult with your own tax counsel to better understand the taxation prior to electing the benefit coverage for your individual circumstance.

To calculate the imputed income for the difference in adding a domestic partner, please see the below example.

Electing two adult coverage under Panther Gold

(July 1, 2023 – June 30, 2024)

Two Adult University Contribution $1,285

Individual University Contribution - $553

Total Imputed Income Amount $732

Please review the below sample pay statement that reflects how this taxation will apply.

Faculty in a Bargaining Unit

After-Tax Deduction

The University follows guidance of the IRS in determining taxation of benefits. The employee contribution towards the cost of adding a domestic partner will be taken on an after-tax basis.

To calculate the after-tax deduction, please see the below example:

Electing two adult coverage under Panther Gold

(July 1, 2023 – June 30, 2024)

Two Adult Contribution $310

Individual Contribution - $86

Total After-Tax Amount $224

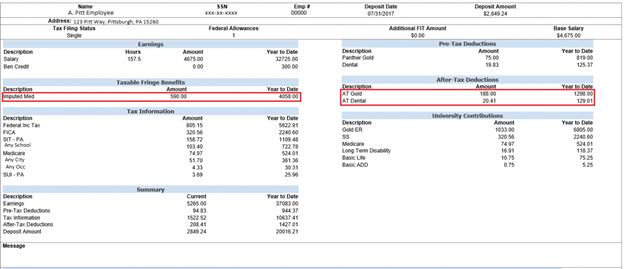

Imputed Income

Imputed income is the estimated value of the employer’s financial contribution towards health insurance coverage for domestic partners and must be reported as taxable wages earned. This tax penalty, depending on the individual and the estimated value of the health benefit, can be large. You are advised to consult with your own tax counsel to better understand the taxation prior to electing the benefit coverage for your individual circumstance.

To calculate the imputed income for the difference in adding a domestic partner, please see the below example.

Electing two adult coverage under Panther Gold

(July 1, 2023 – June 30, 2024)

Two Adult University Contribution $1,205

Individual University Contribution - $518

Total Imputed Income Amount $687

Please review the below sample pay statement that reflects how this taxation will apply.